The science of success

There’s more than one path to financial success

It’s the perfect time to start making your money moves in 2023. Take control of your finances by having additional cashflows to help you live the life you want. Here’s some ideas.

- Save more with a high-interest savings account. Sign up for Momentum Money and earn a compelling interest rate on your savings balance.

- Earn more with dividend investing. Buy stocks in a company and receive cash payouts as a shareholder.

- Make extra money with a side hustle. An entrepreneurship path can give you additional cash.

Make your money moves today. Speak to one of our financial advisers to find out how.

Momentum x Unisa

Recent events and prevailing economic uncertainty have reminded us that we don’t have control over what happens worldwide. The good news is that there is a formula for financial success. Making reactive moves can lead to regrets, but financial success can be achieved through insightful advice, empowering tools and sound money habits.

SUMMARY OF OUR FINDINGS

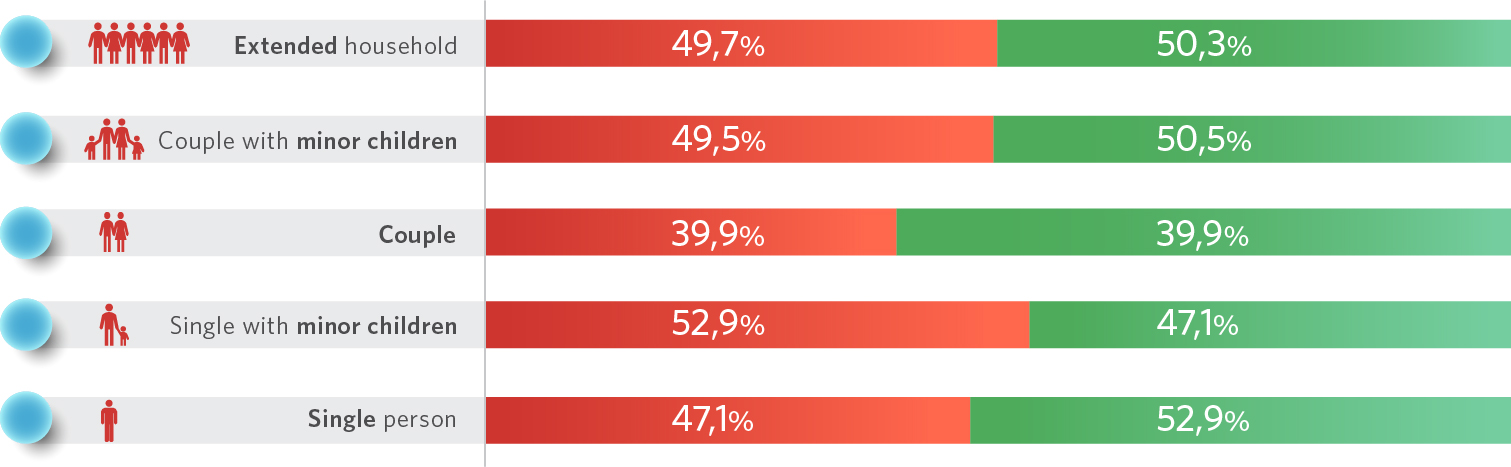

Household types and their financial goals

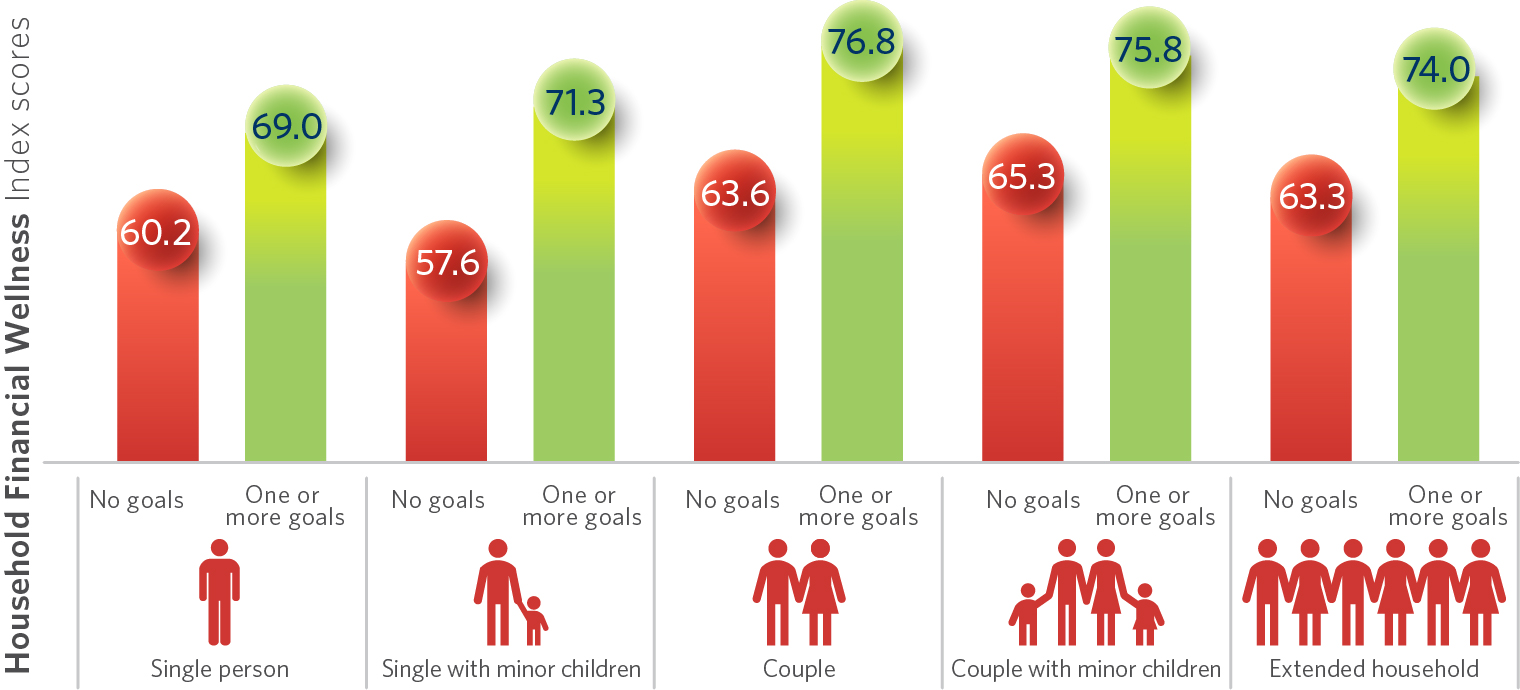

Couples (with or without children) who set financial goals had the highest Financial Wellness Index scores, exceeding the national average. The difference in the Financial Wellness Index scores is relatively large between those with and without goals, again highlighting the importance of setting and pursuing goals as key drivers towards financial wellness.

Financial wellness scores

In all types of households, those with financial goals had a higher financial wellness score compared to those without any goals. Single households with minor children who had no goals had the lowest Financial Wellness Index scores.

5 Money moves to help you build financial resilience

Join the conversation

Switch up your money moves with #SuccessIsAScience.